What is a TFSA?

In 2009, the federal government introduced Tax-Free Savings Accounts (TFSAs). A TFSA is a special savings tool offered by the government, allowing you to save money throughout your lifetime without paying taxes on the interest or investment gains you earn.

The key distinction of a TFSA is that while you don't receive a tax deduction when contributing (like you do with an RRSP), any withdrawals made from the account are not subject to capital gains tax by the Canada Revenue Agency (CRA). And you have the flexibility to withdraw money from your TFSA at any time for any purpose, whether it's for a special occasion like a wedding or vacation, or to help pay for a new car or get you through a lay-off. You can withdraw money easily at any time with no penalties.

How do you open a TFSA?

To open a TFSA, you must be at least 18 years old and have a valid social insurance number (SIN). There are annual contribution limits, or in other words the government limits how much money you can add to a TFSA each year (otherwise billionaires would use this to avoid paying any taxes).

But the nice thing is that any unused contribution room carries forward to future years, giving you flexibility in your savings journey. So if the limit on how much the Canadian government allowed people to add to their TFSA in 2016 was $6,000, and you didn’t add money to it that year, you can still add that $6,000 even in 2024! You automatically gain contribution room each year (the CRA does this for you) and it never expires.

While you technically can use your TFSA as a short-term savings account, it was really designed for investing (we’re just as confused as you on why they named it a “savings account”, but I digress)! If you use your TFSA as a savings account, you’re missing out on the main benefit of a TFSA, which is that any money you earn from interest or investing is tax-free!

Here’s an example:

Let’s say I opened a TFSA in 2024 and I contribute $5,000 each year for 35 years until I retire. If I just left it to sit there and earn interest (let’s say 1.5%) as a savings account, by the time I’m ready to retire it would be worth $228,000! I will have contributed $175,000 of my own money, and I will have earned $53,000 in interest. And the government won’t charge me any taxes on that $53,000 that I earned for free from interest when I take it out because it was sitting in a TFSA.

Now, let’s say instead of using my TFSA as a savings account I chose to open a TFSA that allows me to invest my money (let’s say it gets on average a 7% return). If I contribute $5,000 for 35 years I’ll have contributed the same $175,000 of my own money. By the time I retire it will be worth a whopping $726,666! That means I will have earned $552,000 in interest (this is why investing is so important!!) and none of that money will be taxed when I go to withdraw it!

Since a TFSA lets you earn money and never pay taxes on it, the goal should be to maximize how much money you earned inside that account so you can keep every penny instead off sending a large chunk to the government.

TFSA Contribution Limits:

Now, of course there’s limits on how much money you’re allowed to put into a TFSA each year because the government doesn’t get a piece of the pie you’re earning.

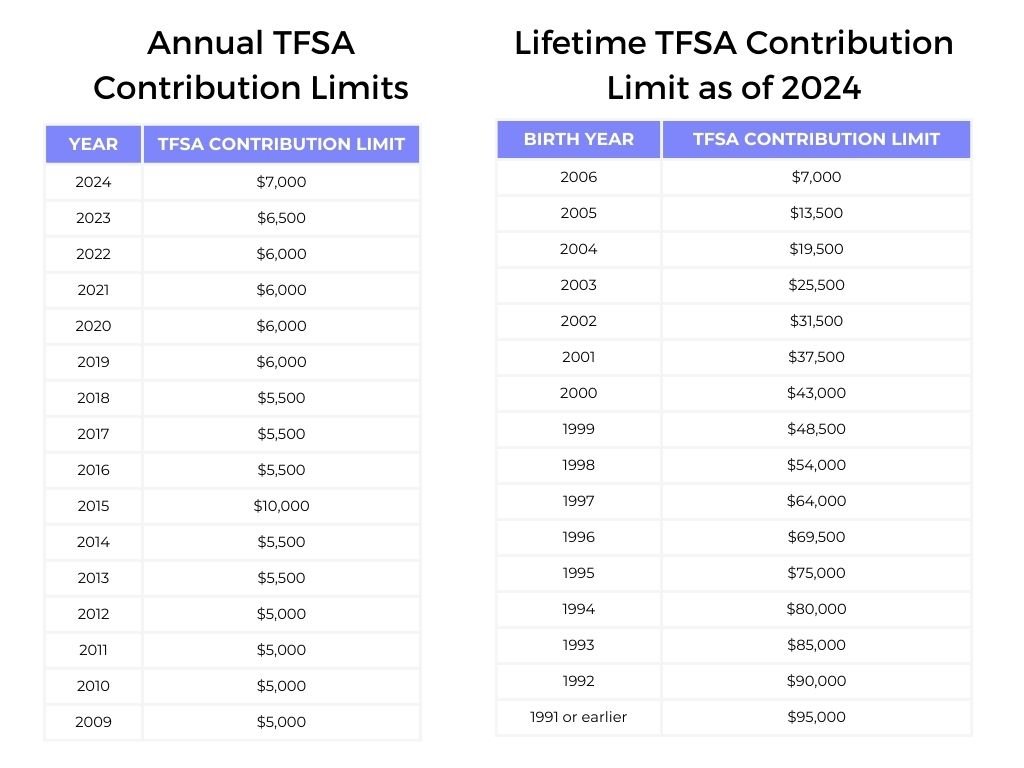

Every year the government announces how much the TFSA contribution limit will be for the next year. For example, the limit for 2023 was $6,500 and for 2024 it is $7,000. One really great thing about this limit is that it never expires. So if you had no money to invest in 2023, but you’re able to invest in 2024, you could add the full $13,500 in 2024!

Since the TFSA was introduced in 2009, anyone who was 18 years old or older started accumulating contribution room that year. If you fall into this category, your lifetime contribution room as of 2024 is $95,000. That means if you’ve never added money to a TFSA and you won the lottery, you could deposit all $95,000 tomorrow.

If you turned 18 after 2009, you can add up the yearly amounts for all of the years that you were 18. Here’s a handy chart to help you do that (note that if you log into your Canada Revenue Agency account they’ll have your contribution room listed, which is handy to check to make sure you don’t go over your limit).

If you exceed your contribution room, the CRA will charge you fees. So make sure you keep track of how much you add! The amount shown in your CRA online account is only updated at the beginning of the year, so make sure you keep track of any money you put into it throughout the year.

Withdrawing Money From Your TFSA:

When it comes to withdrawing money from a TFSA, you don’t need to wait until you retire to access it (even though your goal should be to allow money to sit in there as long as possible so it can grow for free!).

If you want to withdraw money from a TFSA you can do this anytime and there’s no charge for doing this (e.g., you won’t be required to submit it during tax-season and pay any income tax on it). However, you will need to wait until January 1st of the next year for your contribution room to be added.

So if you’ve used up all of your lifetime contribution room and you withdraw $5,000 in June 2023, you need to wait until June 2024 for your contribution room to refresh so you can add it back in. Now this is only an issue if you’ve maxed out your lifetime contribution room- if you’ve got $95,000 room available and only have $10,000 sitting in it, you can add that $5,000 back in right away since you’ve got plenty of extra room left.

KEY TAKEAWAYS:

Despite its name, the benefits you receive from a TFSA are best realized when you use it to invest, not as a regular savings account.

Even though you won't receive a tax deduction upon contributing, any interest earned or investment gains within a TFSA are tax-free.

You start accumulating contribution room as soon as you turn 18 years old, even if you don’t start adding money to the account until you’re much older.

You can withdraw money anytime from a TFSA penalty-free (no need to pay tax on it).

About The Author

Amanda and Siobhan found a shared passion for personal finance shortly after completing their MBAs in 2018. Amanda excelled as a Director of Product in the tech industry, while Siobhan established herself as a leader in e-commerce before transitioning to academia as a Professor.

In 2020, they joined forces to found Hiver Academy, a platform born from their own experiences and triumphs in conquering student loans and building wealth. Realizing that financial success is within reach once the complexities are simplified, their mission now revolves around empowering individuals to achieve financial freedom.

With a wealth of knowledge and a commitment to demystifying money and investing, Amanda and Siobhan are dedicated to helping others navigate the path to success.